Can You Write Off Orthodontic Braces On Your Taxes . Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web the good news is that the cost of braces is deductible on your income taxes. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Whether you can claim the deduction depends on a. Web this interview will help you determine if your medical and dental expenses are deductible. The medical expense deduction has to meet a rather. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web yes, orthodontic treatment is a deductible medical expense.

from www.huntinghillsdentistry.com

Web yes, orthodontic treatment is a deductible medical expense. Web this interview will help you determine if your medical and dental expenses are deductible. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. The medical expense deduction has to meet a rather. Web the good news is that the cost of braces is deductible on your income taxes. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. Whether you can claim the deduction depends on a. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible.

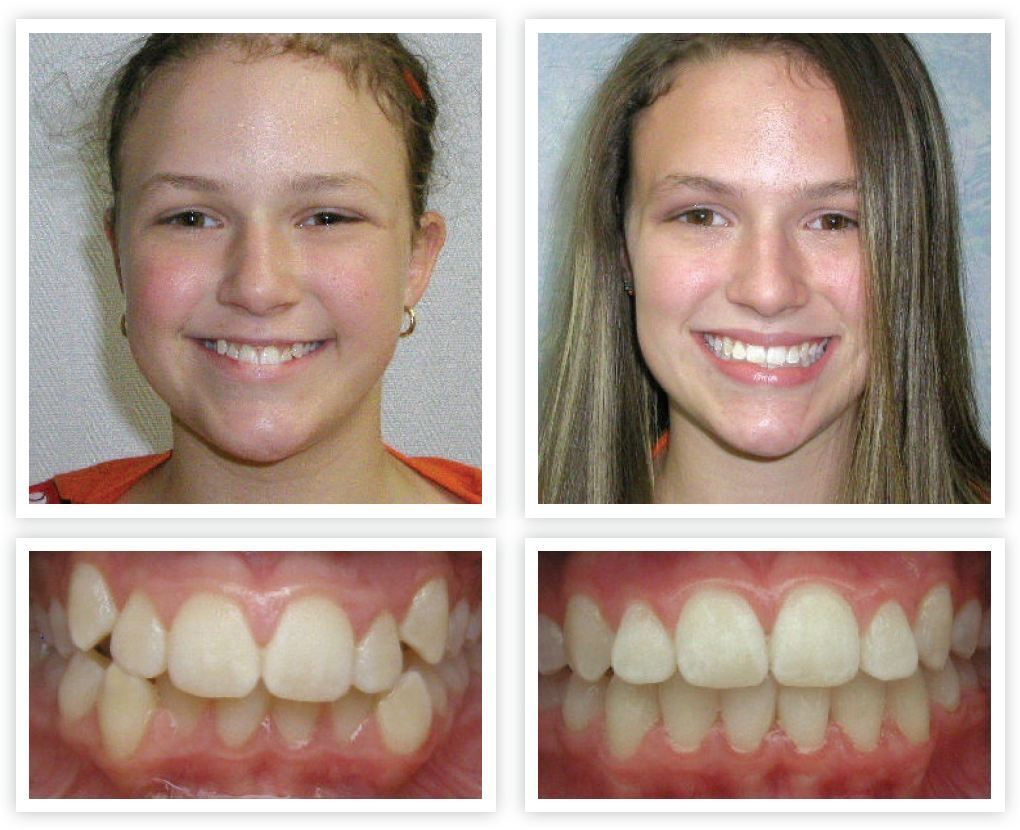

Orthodontic Treatment Roanoke, VA Dentist

Can You Write Off Orthodontic Braces On Your Taxes Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Whether you can claim the deduction depends on a. The medical expense deduction has to meet a rather. Web this interview will help you determine if your medical and dental expenses are deductible. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web yes, orthodontic treatment is a deductible medical expense. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Web the good news is that the cost of braces is deductible on your income taxes. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted.

From www.youtube.com

How Braces Work Elements of the orthodontic treatment and its role © YouTube Can You Write Off Orthodontic Braces On Your Taxes Web the good news is that the cost of braces is deductible on your income taxes. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web this interview will help you determine if your medical and dental expenses are deductible. Web yes, you. Can You Write Off Orthodontic Braces On Your Taxes.

From dforthodon.com

Types of Braces Atlanta Orthodontist Davis Family Orthodontics Can You Write Off Orthodontic Braces On Your Taxes Web yes, orthodontic treatment is a deductible medical expense. Web this interview will help you determine if your medical and dental expenses are deductible. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web importantly, the orthodontic expenses you pay must be deducted. Can You Write Off Orthodontic Braces On Your Taxes.

From salembraces.com

Importance of Regular Braces Appointment McDonald Orthodontic Can You Write Off Orthodontic Braces On Your Taxes Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web yes, orthodontic treatment is a deductible medical expense. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. The medical expense deduction. Can You Write Off Orthodontic Braces On Your Taxes.

From www.artorthodontics.com

Orthodontic Brackets (Braces) How do They Work? ART Orthodontics Davie FL Can You Write Off Orthodontic Braces On Your Taxes Web the good news is that the cost of braces is deductible on your income taxes. Web this interview will help you determine if your medical and dental expenses are deductible. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. Web yes, orthodontic treatment is a deductible medical. Can You Write Off Orthodontic Braces On Your Taxes.

From www.holtorthodontics.com

5 Steps To Getting Braces On and Off Can You Write Off Orthodontic Braces On Your Taxes Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. The medical expense deduction has to meet a rather. Web if your orthodontic. Can You Write Off Orthodontic Braces On Your Taxes.

From aryadentalclinic.com

Orthodontic treatment Conventional Orthodontic Braces and Invisalign Clear Aligners Arya Can You Write Off Orthodontic Braces On Your Taxes Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web the good news is that the cost of braces is deductible on your income taxes. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more. Can You Write Off Orthodontic Braces On Your Taxes.

From www.thantakit.com

Dental Braces Their Types and Costs Can You Write Off Orthodontic Braces On Your Taxes Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web yes, orthodontic treatment is a deductible medical expense. Whether you can claim the deduction depends on a. The medical expense deduction has to meet a rather. Web the good news is that the cost of braces. Can You Write Off Orthodontic Braces On Your Taxes.

From santabarbaraortho.com

Caring for Teeth With Braces Wright and Feusier Orthodontics Call Now Can You Write Off Orthodontic Braces On Your Taxes Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Web the good news is that the cost of braces is deductible on your income taxes. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web yes, orthodontic. Can You Write Off Orthodontic Braces On Your Taxes.

From www.whitecoatsclinic.com

Orthodontics Braces Whitecoats Clinic Can You Write Off Orthodontic Braces On Your Taxes The medical expense deduction has to meet a rather. Web the good news is that the cost of braces is deductible on your income taxes. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web this interview will help you determine if your medical and dental. Can You Write Off Orthodontic Braces On Your Taxes.

From www.dentalclinic-knet.com

BRACES OFF Step by step orthodontic removal Dental Clinic Can You Write Off Orthodontic Braces On Your Taxes Web this interview will help you determine if your medical and dental expenses are deductible. The medical expense deduction has to meet a rather. Whether you can claim the deduction depends on a. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. Web the good news is that. Can You Write Off Orthodontic Braces On Your Taxes.

From navanorthodontics.ie

Tax back on brace treatment claim your tax back Navan Orthodontics Can You Write Off Orthodontic Braces On Your Taxes Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. The medical expense deduction has to meet a rather. Web if. Can You Write Off Orthodontic Braces On Your Taxes.

From www.pinterest.com

Have you been putting off Braces? Infographic It's never too late for braces Apocalypse Now Can You Write Off Orthodontic Braces On Your Taxes The medical expense deduction has to meet a rather. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Web you can deduct on schedule a (form 1040) only. Can You Write Off Orthodontic Braces On Your Taxes.

From fischerinstitute.com

How Much Will Cost to Remove Braces Without Insurance How You Can Reduce Expenses Can You Write Off Orthodontic Braces On Your Taxes Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. The medical expense deduction has to meet a rather. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Web the good news is that the cost of braces is deductible. Can You Write Off Orthodontic Braces On Your Taxes.

From oasisorthodontics.com.au

Orthodontic Braces Perth Oasis Orthodontics Can You Write Off Orthodontic Braces On Your Taxes Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. Web yes, orthodontic treatment is a deductible medical expense. Web this interview will help you determine if your medical and dental expenses are deductible. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well. Can You Write Off Orthodontic Braces On Your Taxes.

From taxsaversonline.com

Best Tax Write Offs for Dentists in 20212022 Can You Write Off Orthodontic Braces On Your Taxes Whether you can claim the deduction depends on a. Web this interview will help you determine if your medical and dental expenses are deductible. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay. Can You Write Off Orthodontic Braces On Your Taxes.

From sendika8.org

Orthodontic Specialists Provide Various Brace Types sendika8 Can You Write Off Orthodontic Braces On Your Taxes Web importantly, the orthodontic expenses you pay must be deducted from your taxes for the year you pay them, even if you receive. Whether you can claim the deduction depends on a. The medical expense deduction has to meet a rather. Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental. Can You Write Off Orthodontic Braces On Your Taxes.

From www.blueridgeorthodontics.com

How Do Your Teeth Move? Blue Ridge Orthodontics Can You Write Off Orthodontic Braces On Your Taxes Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web if your orthodontic treatment is medically necessary, then yes, your braces could very well be tax deductible. Whether you can claim the deduction depends on a. Web yes, you can claim your child's. Can You Write Off Orthodontic Braces On Your Taxes.

From www.muskandentalcare.com

Dental Braces Treatment in Delhi NCR Orthodontic Treatment Wires and Braces Delhi Can You Write Off Orthodontic Braces On Your Taxes Web yes, you can claim your child's braces as an itemized deduction if you have enough medical and dental expenses and. The medical expense deduction has to meet a rather. Web you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted. Web the good news. Can You Write Off Orthodontic Braces On Your Taxes.